The $70K Tax Refund of 2022

**Disclaimer: I am not a tax professional. I post this to encourage you to seek guidance from a dental specific tax professional. I am not offering advice and this should not be considered a representation of law or an interpretation of the Tax Code.**

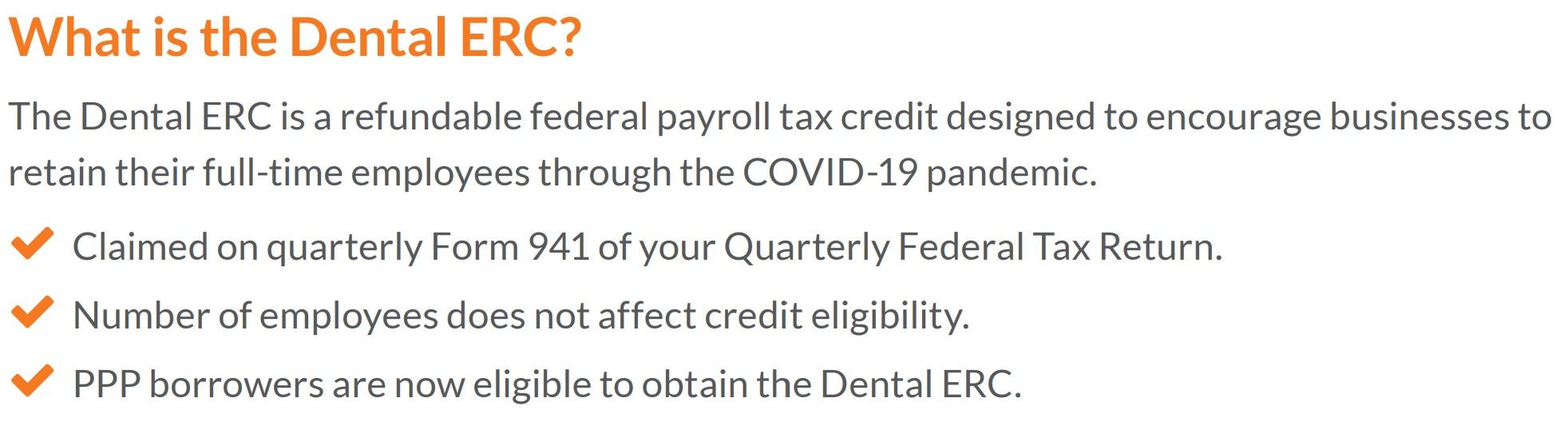

What is the Employee Retention Tax Credit (ERTC)?

The Dental Employee Retention Tax Credit (ERTC) is stimulus benefit available to many dental practices and may allow for an average of $70,600 in refundable tax credits. Of course, this is an average and individual practice situations will vary. Aprio is a top-rated CPA and advisory services firm that affiliates with Patterson Dental. All photos and information were extracted from Aprio's article "The Dental Employee Retention Credit" attached at the bottom of this post. However, your current CPA should help you navigate this topic and I highly suggest bringing this information to their attention.

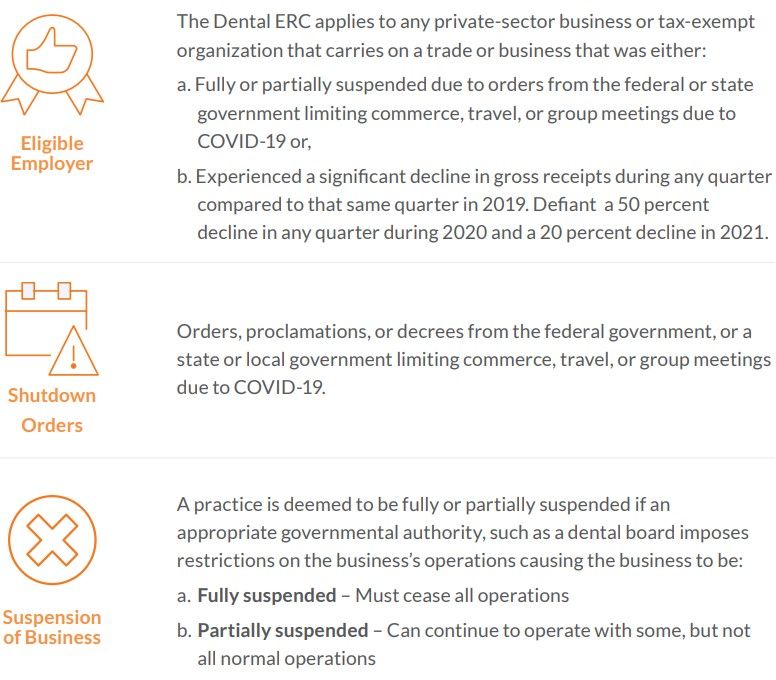

How Can It Apply?

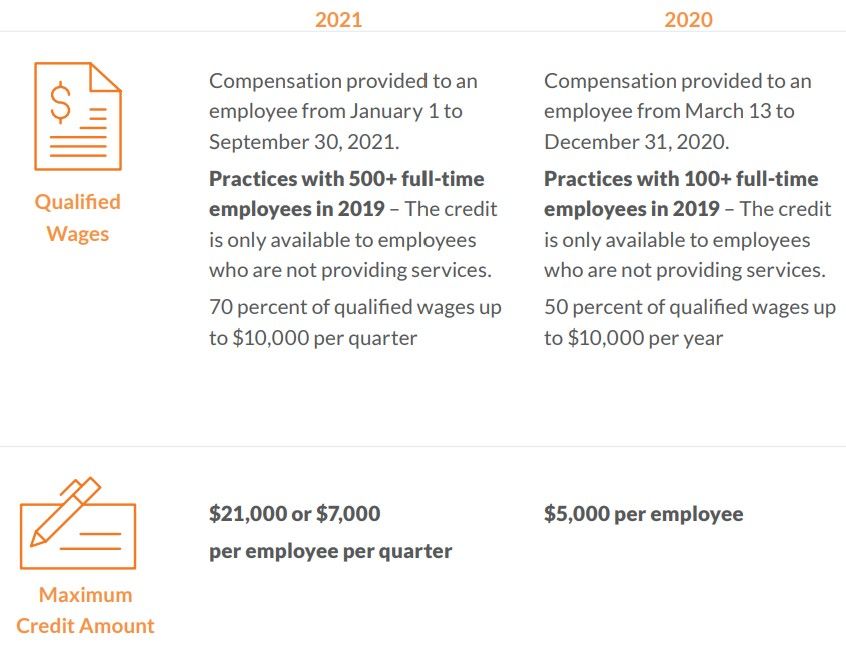

How Credits May Look?

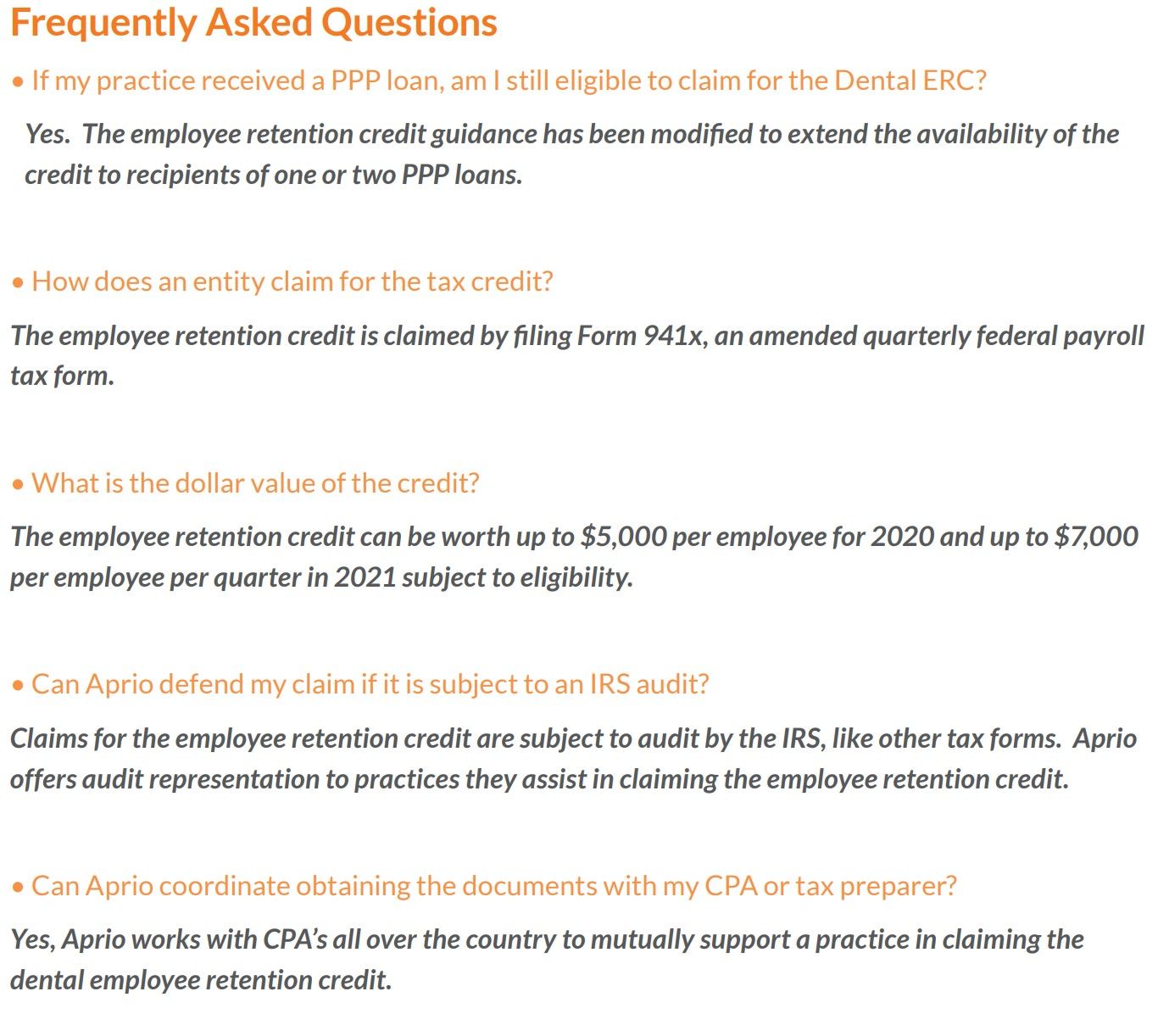

Frequently Asked Questions (FAQs)

Potential Next Steps...

Speak with your CPA regarding the Employee Retention Tax Credit (ERTC). It is a newer benefit and many CPA's may require further education.

Aprio hired team members who contributed to the laws surrounding the Employee Retention Tax Credit. They can be a great resource since consultations to determine potential rebates are free. Below is a link to book a free consultation.

Thank you for taking the time to read about the Employee Retention Tax Credit (ERTC). If this was at all helpful, please feel free to sign up for the occasional email resource here:

Aprio Downloadable Overview and FAQ

Contact Information:

Benjamin (Ben) Holguin

ben.holguin@pattersondental.com

714-560-3724